Amortization Calculator

An Amortization Calculator enables you to know the exact breakdown of your loan repayments (EMIs) as principal and interest for the entire loan duration. It provides a detailed month-by-month or year-by-year rundown, called an amortization schedule, so you can more easily plan and track your finances.

Amortization Calculator

Comprehensive financial planning tool for Indian home loans

Loan Details

Prepayment Options

Lump Sum Details

Regular Payment Details

Tax Benefit Details

Loan Summary

Monthly EMI

₹ 0

Total Interest Payable

₹ 0

Total Amount Payable

₹ 0

With Prepayments:

Revised EMI/Tenure

--

Interest Saved

₹ 0

Total Prepayment

₹ 0

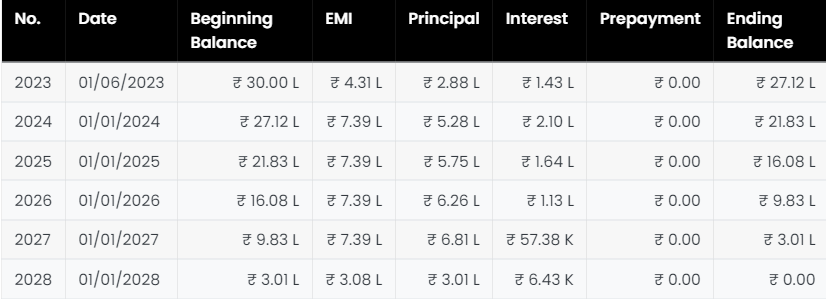

| No. | Date | Beginning Balance | EMI | Principal | Interest | Prepayment | Ending Balance |

|---|

Tax Benefit Summary (First Year)

Section 80C - Principal Repayment

Maximum deduction allowed: ₹1,50,000 per financial year

Deduction available only on completed property

Section 24(b) - Interest Payment

For self-occupied property: Maximum deduction of ₹2,00,000 per financial year

For let-out property: Entire interest is deductible

Additional Benefits:

- Section 80EE: Additional ₹50,000 for first time home buyers (if eligible)

- Section 80EEA: Additional ₹1,50,000 for affordable housing (if eligible)

Original Loan

With Prepayment

In a country like India, where EMIs are the most popular mode of financing big-ticket purchases, this calculator becomes extremely handy for borrowers interested in:

- Calculate the cost of their credit imposes over time

- Monitor how the loan balance decreases with each monthly payment

THIS RATESHEET HAS BEEN DESIGNED TO PROTECT YOU IF PREPAID OR EARLY CLOSED

Sample Amortization Schedule (Monthly & Yearly)

What is an Amortization Calculator?

An Amortization Calculator is a powerful financial tool that helps borrowers clearly understand how their loan repayment commonly known as EMIs (Equated Monthly Installments) are structured over the full term of the loan. When you take a loan (such as a home loan, personal loan, or car loan), your monthly EMI includes two components: Principal and interest.

The principal is the actual loan amount you borrowed, while the interest is the cost charged by the lender (bank or NBFC) for giving you the loan. Over time, as you make consistent monthly payments, the balance of the loan reduces, and the proportion of your EMI going toward interest gradually decreases, while the portion going toward principal repayment increases. This progressive repayment structure is referred to as loan amortization.

An amortization calculator automatically generates a complete schedule called an amortization table which shows, month by month or year by year.

- The fixed EMI amount.

- The interest portion of each payment.

- The principal portion of each payment.

- The remaining outstanding loan balance after each payment.

This level of detail provides borrowers with transparency and insight into how their loan is being repaid over time, helping them:

- Plan prepayments or early closures more effectively.

- Understand how much they’re pay in annually.

- Estimate annual deductions for tax benefits under Section 80C and Section 24(b) of the Income Tax Act.

- Strategically manage long-term financial planning and budgeting.

MasterCalculator.in Amortization Calculator empowers you to take full control of your loan, ensuring you’re never in the dark about where your money is going, how much your loan is costing you, and how you can potentially save more by optimizing your repayment strategy.

Who Should Use This?

| User Type | How It Helps |

|---|---|

| Home Loan Borrowers | Plan repayment and prepayment to save on interest |

| Car/Personal Loan Borrowers | Track your total cost and manage monthly budgets |

| Students with Edu Loans | Understand how your EMIs will evolve after moratorium |

| Taxpayers | Estimate annual principal and interest for deductions |

| Financial Advisors | Present professional schedules to clients |

🇮🇳 Indian Context & Customization

At MasterCalculator.in, our Amortization Calculator is built for the Indian market:

✅ Supports Indian banks’ EMI structure

✅ Displays values in lakhs and crores using the Indian numbering system

✅ Allows export of amortization table for tax filing or audit use.

✅ Compatible with floating-rate loans (coming soon)

✅ Localized for INR ₹ with options to choose monthly or yearly views