IRR Calculator

In the world of finance and investment decision-making, Internal Rate of Return (IRR) is a key metric used to evaluate the profitability and efficiency of an investment. An IRR calculator simplifies this process by automatically computing the IRR based on the cash inflows and outflows over a period of time. In the Indian financial landscape, the IRR calculator plays a vital role for individuals, businesses, mutual fund investors, startups, and real estate players.

IRR Calculator (Internal Rate of Return) - India

Fixed Cash Flow Inputs

IRR Results

Cash Flow Projection

IRR Comparison with Indian Benchmarks

Investment Analysis

Complete the calculation to see your investment analysis.

Irregular Cash Flow Inputs

Cash Flow Entries

Enter negative values for outflows (investments) and positive for inflows (returns)

IRR Results

Cash Flow Projection

IRR Comparison with Indian Benchmarks

Investment Analysis

Complete the calculation to see your investment analysis.

Project Comparison Tool

Compare up to 3 different investment projects side by side.

Project 1

Project 2

Project 3

IRR Comparison

Risk-Return Analysis

Project Comparison Analysis

| Project | Investment (₹) | Duration | IRR | Risk Level | Category | Risk-Adjusted Return | Benchmark Difference |

|---|

Recommendation

Compare projects to see recommendations.

Internal Rate of Return (IRR) Guide for Indian Investors

What is IRR?

Internal Rate of Return (IRR) is the discount rate at which the net present value (NPV) of all cash flows from an investment becomes zero. It's a metric used to estimate the profitability of potential investments.

In simpler terms, IRR is the annual growth rate that an investment is expected to generate. It's particularly useful when comparing different investment opportunities with varying cash flow patterns and time periods.

IRR in the Indian Context

In India, IRR expectations typically need to be higher than in developed economies due to higher inflation, currency risk, and higher costs of capital. While a 8-10% IRR might be acceptable in the US or Europe, Indian investments often target 15-20% or higher to be considered attractive.

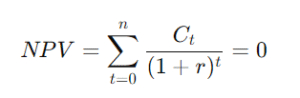

IRR Formula

NPV = 0 = CF0 + CF1/(1+IRR)1 + CF2/(1+IRR)2 + ... + CFn/(1+IRR)n

Where CF represents cash flows (CF0 is typically negative, representing the initial investment)

IRR Benchmarks in India (2023)

| Investment Type | Typical IRR Range | Risk Level | Notes |

|---|---|---|---|

| Fixed Deposits | 5.5% - 7.5% | Low | Varies by bank and term length |

| Government Bonds | 7.0% - 8.0% | Low | 10-year yield benchmark |

| Corporate Bonds | 8.0% - 12.0% | Moderate | Depends on credit rating |

| Equity Mutual Funds | 12.0% - 15.0% | High | Long-term average returns (CAGR) |

| Residential Real Estate | 8.0% - 14.0% | Moderate-High | Tier 1 cities, includes rental yield |

| Commercial Real Estate | 12.0% - 18.0% | High | Prime locations |

| Private Equity | 20.0% - 30.0% | Very High | Early-stage investments |

| Infrastructure Projects | 14.0% - 20.0% | High | Regulated sectors |

India-Specific IRR Considerations

1. Inflation Impact

India typically experiences higher inflation rates (averaging 4-6% annually) than developed economies. When calculating IRR, consider adjusting for inflation to determine the real rate of return.

2. Tax Implications

Different asset classes in India have varying tax treatments:

- Equity investments held for more than 12 months: LTCG tax of 10% above ₹1 lakh

- Debt investments: LTCG tax of 20% with indexation benefits

- Real Estate: LTCG tax of 20% with indexation benefits, plus potential rental income tax

- Business income: Taxed at corporate tax rates (22-30% depending on structure)

3. Currency Risk

For international investments, the Indian Rupee's historical depreciation trend (approximately 3-5% annually against the USD) should be factored into IRR calculations.

4. Liquidity Premium

Indian markets often have lower liquidity compared to developed markets. Investments with lower liquidity should command higher IRRs to compensate for this risk.

Common IRR Misconceptions

Misconception 1: Higher IRR Always Means Better Investment

IRR doesn't account for the absolute return or the investment scale. A ₹10,000 investment with 25% IRR generates less absolute return than a ₹1,00,000 investment with 15% IRR.

Misconception 2: IRR Equals Annual Return

IRR assumes all intermediate cash flows are reinvested at the IRR itself, which may not be practically possible in fluctuating Indian interest rate environments.

Misconception 3: IRR Factors in All Risks

IRR is a numerical measure that doesn't inherently account for various risks like regulatory changes, market volatility, or project delays that are particularly relevant in the Indian context.

Sector-Specific Hurdle Rates in India

IT/Technology

18-22%

Higher for startups, lower for established firms

Manufacturing

16-20%

Varies by industry segment and location

Retail

20-25%

Higher in Tier 2/3 cities due to risk

Renewable Energy

14-18%

Lower for projects with PPA

Healthcare

18-24%

Lower for hospitals, higher for biotech

Agriculture

15-20%

Higher for processing, lower for farming

What is IRR (Internal Rate of Return)?

IRR is the discount rate that makes the Net Present Value (NPV) of all future cash flows (both incoming and outgoing) from a particular investment equal to zero. It represents the annualized effective compounded return rate that can be earned on the invested capital.

Mathematical Definition:

The IRR is the rate r that satisfies the following equation:

Where:

- Ct = Net cash inflow during the period t

- r = Internal rate of return (IRR)

- t = Number of time periods

What is an IRR Calculator?

An IRR calculator is a digital or spreadsheet-based tool that helps you calculate the Internal Rate of Return based on a series of cash flows over a specific period. It automates the complex mathematical calculation of IRR and gives you the result in seconds.

In India, IRR calculators are widely used by:

- Stock investors

- Mutual fund analysts

- Startup founders

- Angel investors

- Real estate developers

- Corporate finance professionals

- Chartered Accountants and Tax Planners

How Does an IRR Calculator Work?

To use an IRR calculator, you need to input:

- Initial Investment (usually a negative cash flow)

- Subsequent cash flows (positive or negative) for each period

- Time period (years, quarters, or months depending on the investment)

Example:

| Year | Cash Flow (₹) |

|---|---|

| 0 | -1,00,000 |

| 1 | 20,000 |

| 2 | 30,000 |

| 3 | 25,000 |

| 4 | 35,000 |

| 5 | 40,000 |

By inputting this into the IRR calculator, you get an IRR of approximately 14.49%.

This means your investment has effectively earned you an annual return of 14.49%.

Importance of IRR Calculator in Indian Finance:

1. Mutual Fund Investments

Indian investors track the IRR (often shown as XIRR) of their SIP or lump sum mutual fund portfolios. This helps compare schemes with variable returns.

2. Real Estate Projects

Builders and investors calculate IRR to evaluate the returns on real estate investments over 5–10 years considering rental yield, resale value, and maintenance.

3. Startup Valuation

Startups seeking VC or angel funding in India use IRR projections in pitch decks to demonstrate expected investor returns.

4. Government and Infrastructure Projects

Government-backed PPP (Public-Private Partnerships) often require an IRR of 12–16% to be financially viable.

5. Loan Evaluation

Banks and NBFCs sometimes use IRR to assess profitability from long-term lending instruments.

Benefits of Using IRR Calculator?

📌 Eliminates Complex Math: No need for manual iterations or trial-and-error methods.

📌 Time-Saving: Calculates IRR in seconds.

📌 Scenario Analysis: Try different assumptions for cash flows.

📌 Investment Comparisons: Compare different projects on the same basis.

📌 Decision-Making Tool: Helps investors choose between options.

FAQs on IRR Calculator in India

1. What is a good IRR in India?

A good IRR depends on the investment type. In India:

- Mutual Funds: 12–15% is good.

- Startups: 25–30%+ is expected.

- Real Estate: 10–20% is considered decent.

2. Is IRR better than CAGR?

CAGR works for simple start-to-end calculations, but IRR handles multiple and irregular cash flows better.

3. Can I use IRR for SIP investments?

Yes, use the XIRR function which is better suited for SIPs with non-uniform cash flow dates.

4. What does a negative IRR mean?

A negative IRR indicates the investment is making a loss.

5. Are IRR calculators reliable?

Yes, if the data input is correct, IRR calculators are very reliable.

6. How is IRR used in startup valuation in India?

Founders project IRR on investor funding based on projected future cash flows or exit multiples.

7. Where can I find a good IRR calculator online in India?

Try platforms like:

- MasterCalculator.in

- Groww.in

- ClearTax.in

8. Can IRR help in real estate buying decisions?

Yes, it gives a better picture when rent, appreciation, loan EMI, and taxes are considered.

9. Does IRR work for tax planning?

It helps assess the post-tax returns of investments and compare tax-saving options.

10. Can IRR be more than 100%?

Yes, in some early-stage investments or IPOs, IRRs can exceed 100% if returns are exceptionally high.