Loan Calculator

This loan calculator is designed to help users determine their monthly payments, total payments over the term, and total interest paid on a fixed-term loan. It’s especially useful for personal, auto, or home loans where payments are made monthly with a fixed interest rate.

Loan Payment Calculator

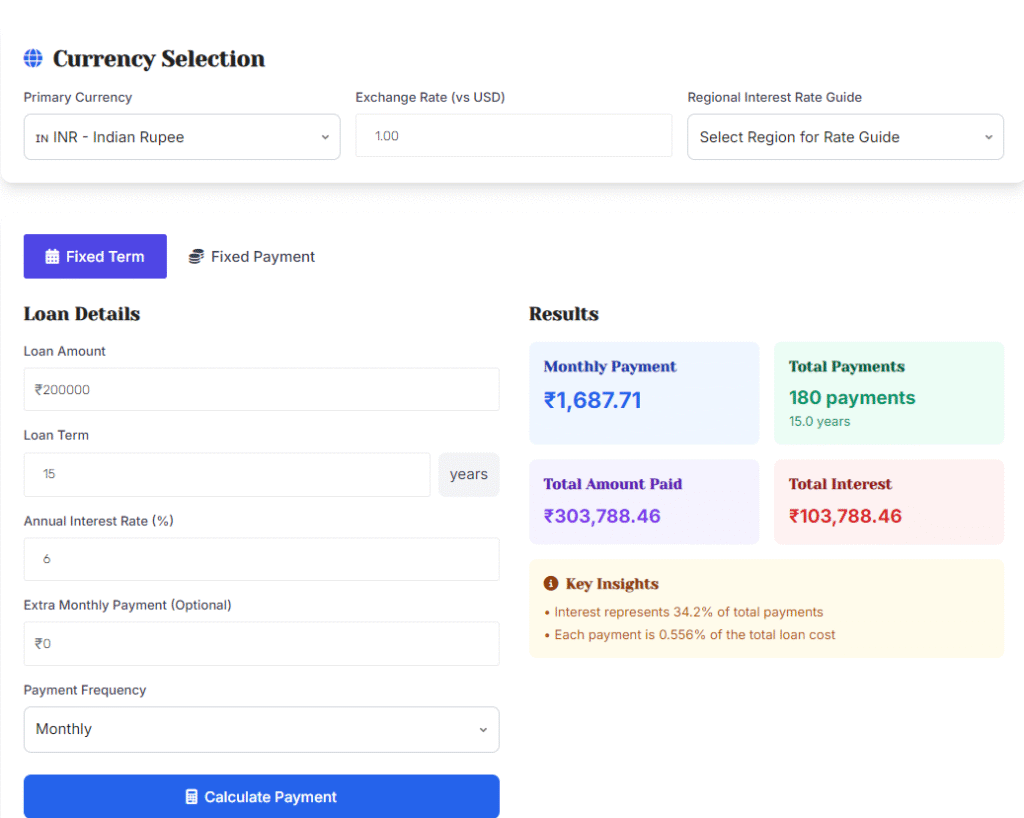

Currency Selection

Loan Details

Results

Enter loan details and click calculate to see results

Loan Details

Results

Enter payment details and click calculate to see results

Payment Breakdown

Balance Over Time

Amortization Schedule

| Payment # | Payment Date | Payment Amount | Principal | Interest | Balance |

|---|---|---|---|---|---|

| No amortization schedule available. Please calculate a loan first. | |||||

Loan Comparison Tool

Scenario A

Scenario B

Recommendations

Financial Insights & Tips

Interest Rate Impact

A 1% increase in interest rate can add thousands to your total payment over the loan term.

Extra Payments

Adding even $50-100 extra per month can save years off your loan and thousands in interest.

Bi-weekly Payments

Switching to bi-weekly payments can reduce your loan term by 4-6 years on a 30-year mortgage.

Currency Fluctuation

For international loans, currency exchange rates can significantly impact your total cost.

APR vs Interest Rate

Always compare APR, which includes fees, rather than just the interest rate.

Refinancing

Monitor interest rates regularly - refinancing can save significant money if rates drop.

Loan Details of Loan Calculator?

| Field | Example Value | Explanation |

|---|---|---|

| Loan Amount | ₹2,00,000 | The principal amount you want to borrow. |

| Loan Term | 15 years | How long you will take to repay the loan. |

| Annual Interest Rate (%) | 6% | The annual fixed interest rate offered by the lender. |

| Extra Monthly Payment (Optional) | ₹0 | Extra amount you might pay each month to reduce the loan faster. |

| Payment Frequency | Monthly | How often you pay (usually monthly in India). |

Details on each input of the Loan Calculator?

📌 Loan Amount: The principal sum. Adjusting this changes monthly payments proportionally.

📌 Loan Term: A shorter term leads to higher monthly payments but less interest over the loan.

📌 Interest Rate: Major driver of total interest cost. Even small % changes matter a lot.

📌 Extra Monthly Payment: A powerful feature. Even $50–$100 extra monthly can save thousands in interest.

📌 Frequency: Usually monthly, but some calculators let you choose bi-weekly or weekly to model different amortization styles.

Why Use This Loan Calculator?

✔️ Know your EMI before you borrow.

✔️ Budget monthly expenses.

✔️ Avoid surprises about total interest.

✔️ Compare loan offers from different banks.

✔️ Plan for faster payoff with extra payments.

Advantages of The Loan Calculator?

- Easy to use—intuitive form

- Transparent—shows total cost clearly.

- Flexible—test different amounts, terms, and rates.

- Insightful—shows interest as a share of payments.

- Encourages smart borrowing and early repayment.

FAQs on Loan Calculator

1. What is a loan calculator?

A loan calculator is an online tool that helps you estimate your monthly loan payments (EMIs), total interest payable, and overall repayment amount based on your loan amount, interest rate, and repayment term.

2. How do I use this loan calculator?

- Enter your Loan Amount (₹).

- Choose the Loan Term in years.

- Enter the Annual Interest Rate (%) offered by your lender.

- Optionally, add any Extra Monthly Payment you plan to make.

- Choose Payment Frequency (usually monthly).

- Click Calculate Payment to see your results

3. What results will I get?

- Monthly Payment (EMI): Fixed monthly instalment combining principal and interest.

- Total Payments: Number of payments over the term (e.g. 180 payments for 15 years).

- Total Amount Paid: Total of all payments (principal + interest).

- Total Interest: The extra amount you pay over the borrowed principal.

4. What is “Payment Frequency”?

It’s how often you make repayments.

- The default is monthly (common in India).

- Some calculators support biweekly or weekly payments, which can slightly reduce total interest.

5. Can I use this loan calculator for any type of loan?

Yes! It’s suitable for:

✅ Home Loans

✅ Personal Loans

✅ Car Loans

✅ Education Loans

✅ Any fixed-term, fixed-rate loan