RD Calculator

An RD Calculator is an easy-to-use online tool that helps you estimate the maturity amount and interest earned on your recurring deposit investment. By entering details such as monthly contribution, tenure, interest rate, and compounding frequency, you can instantly know how much your RD will be worth at maturity.

RD accounts are popular savings instruments offered by banks and post offices in India, letting you deposit a fixed amount every month and earn guaranteed returns at a fixed interest rate.

Recurring Deposit Calculator - India

Calculate your RD returns with precision, compare investment options, analyze tax implications

RD Calculator

Bank RD Rates

| Bank | General Rate | Senior Citizen |

|---|---|---|

| SBI | 5.75% - 6.25% | 6.25% - 6.75% |

| HDFC Bank | 6.00% - 7.00% | 6.50% - 7.50% |

| ICICI Bank | 6.00% - 7.00% | 6.50% - 7.50% |

| Axis Bank | 6.00% - 7.00% | 6.50% - 7.50% |

| Post Office | 6.20% | 6.20% |

| Bank of Baroda | 5.75% - 6.85% | 6.25% - 7.35% |

*Rates are indicative and subject to change

RD Summary

RD Growth Visualization

Investment Distribution

Interest Growth Year-wise

RD Maturity Calculator Notes:

- Interest is calculated and compounded quarterly in most banks.

- TDS of 10% is applicable if interest income exceeds ₹10,000 in a financial year.

- Senior citizens typically get an additional 0.5% interest rate.

- Premature withdrawal of RDs may incur penalties depending on bank policies.

- Interest earned on RDs is taxable according to your income tax slab rate.

Detailed Monthly Breakdown

| Month | Deposit | Interest Earned | Balance |

|---|

Yearly Accumulation Summary

| Year | Total Deposits | Interest Earned | Year-end Balance |

|---|

Investment Comparison

Investment Comparison

| Parameter | RD | FD | SIP |

|---|---|---|---|

| Risk Level | Low | Low | Moderate to High |

| Returns | 5-7% | 5-7% | 10-15% |

| Liquidity | Moderate | Low | High |

| Tax Efficiency | Low | Low | High (LTCG) |

| Withdrawal | Penalty | Penalty | No Penalty |

| Inflation Beating | No | No | Yes |

When to Choose RD

Ideal for short to medium-term financial goals (1-5 years).

When capital preservation is more important than high returns.

When you want to build a habit of regular saving with fixed returns.

As part of conservative portfolio allocation for stability.

Tax Implications

Tax Efficiency Analysis

Tax Comparison with Other Investments

| Investment Type | Interest/Gain | Tax Rate | Tax Amount | Post-tax Return |

|---|---|---|---|---|

| Recurring Deposit | ₹56,829 | 0% | ₹0 | ₹56,829 |

| Fixed Deposit | ₹51,272 | 0% | ₹0 | ₹51,272 |

| Equity Mutual Fund (> 1 year) | ₹1,32,194 | 10% above ₹1L | ₹3,219 | ₹1,28,975 |

| PPF (Public Provident Fund) | ₹84,313 | Tax Free | ₹0 | ₹84,313 |

Tax Notes:

- Interest earned from RDs is fully taxable as per your income tax slab rate.

- Banks deduct TDS @10% if interest earned in a financial year exceeds ₹10,000.

- If you fall in a higher tax bracket, you need to pay additional tax while filing returns.

- For senior citizens, TDS is deducted if interest exceeds ₹50,000 per financial year.

- Form 15G/15H can be submitted to avoid TDS if your total income is below the taxable limit.

- Tax calculations are indicative and based on current tax laws which may change.

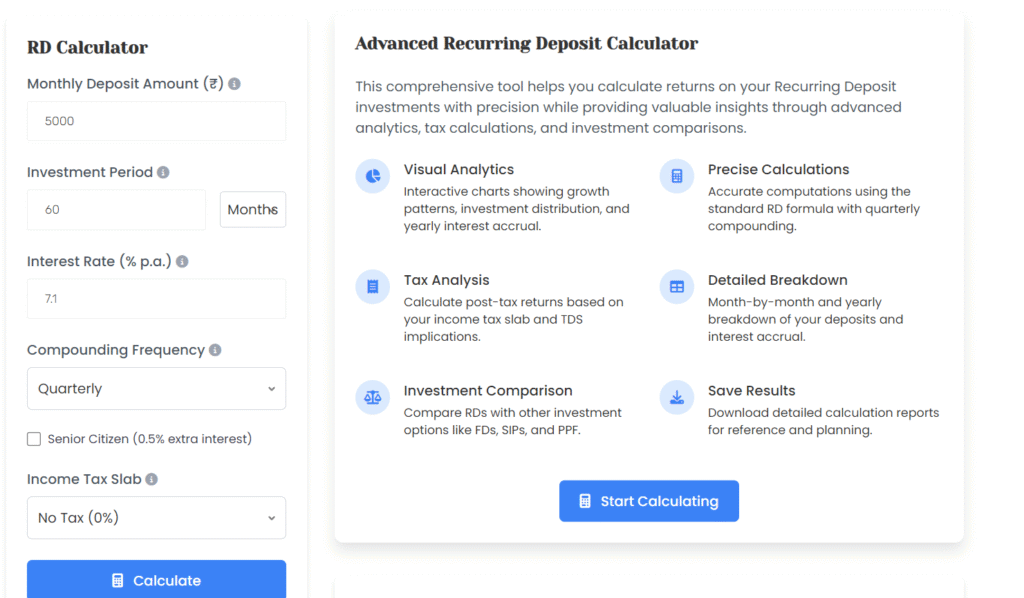

Advanced Recurring Deposit Calculator

This comprehensive tool helps you calculate returns on your Recurring Deposit investments with precision while providing valuable insights through advanced analytics, tax calculations, and investment comparisons.

Interactive charts showing growth patterns, investment distribution, and yearly interest accrual.

Accurate computations using the standard RD formula with quarterly compounding.

Calculate post-tax returns based on your income tax slab and TDS implications.

Month-by-month and yearly breakdown of your deposits and interest accrual.

Compare RDs with other investment options like FDs, SIPs, and PPF.

Download detailed calculation reports for reference and planning.

Understanding Recurring Deposits

What is a Recurring Deposit?

A Recurring Deposit (RD) is a term deposit offered by banks where you deposit a fixed amount every month for a predetermined period. At the end of this period, you receive the principal amount along with interest. RDs are designed to help individuals save regularly and earn fixed returns.

How is RD Interest Calculated?

In India, most banks use the following formula to calculate RD interest:

M = R[(1+i)^n-1]/(1-(1+i)^(-1/3))

Where:

- M = Maturity Value

- R = Monthly Installment

- n = Number of quarters

- i = Rate of interest/400

Interest on RDs is typically compounded quarterly, which means the interest is calculated and added to the principal every quarter.

Key Features of RD Accounts

- Fixed monthly investments for a disciplined saving approach

- Tenure ranging from 6 months to 10 years in most banks

- Fixed interest rates throughout the deposit period

- Option for auto-renewal at maturity

- Nomination facility available

- Premature withdrawal allowed with penalty

- Loan facility available against RD in many banks

- TDS applicable as per income tax rules

Benefits of Using This RD Calculator

✅ Quick and accurate calculation of maturity amount.

✅ Visual understanding through charts and graphs.

✅ Breaks down your investment into principal vs. interest.

✅ Lets you factor in senior citizen bonus rates.

✅ Adjusts for your tax slab to show post-tax returns.

✅ Helps compare banks to get the best rates.

What is a Recurring Deposit (RD)?

A recurring deposit (RD) is one of the well-established savings schemes in India, offered by banks, post offices, and financial institutions. It enables investors to make regular monthly contributions for a predetermined period and earn a guaranteed interest.

Unlike lump-sum FDs, RDs cater to disciplined monthly saving. The sum of all the monthly deposits plus accrued interest is paid to the investor at the end of the 20-year period.

How Does a Recurring Deposit Work?

When you open an RD account:

1️⃣ You select your monthly deposit amount (for example, ₹2,000/month).

2️⃣ You pick the term (i.e., how long you want it—for instance, 5 years).

3️⃣ The bank provides a fixed interest rate (for example, 7% per year).

4️⃣ You pay ₹2,000 per month.

5️⃣ Interest is compounded quarterly.

6️⃣ At maturity, you receive the total amount of your deposits + interest accrued.

Unlike lump-sum FDs, you accumulate your savings gradually, making it best suited for salaried people.

Interest Calculation in RD

Interest is generally compounded quarterly using the formula:

But most people use an RD calculator to avoid manual computation.

Example:

- Monthly deposit: ₹5,000

- Tenure: 5 years

- Rate: 7.1% p.a. (compounded quarterly)

- Maturity amount: ~₹3.6 lakh

- Total invested: ₹3 lakh

- Interest earned: ~₹60,000

Taxation on RD

Interest earned on RD is completely taxable under Heads ‘Income from Other Sources’.

Banks deduct TDS (Tax Deducted at Source) if interest in a financial year crosses ₹40,000 (₹50,000 for senior citizens).

Investors have to declare interest income in their tax returns and pay tax as per their slab.

Example:

If you are in the 20% slab and earned ₹10,000 as interest, you will have to pay ₹2,000 as tax.

Popular Banks & Post Office RD Rates

| Institution | Regular Rate (p.a.) | Senior Citizen Rate (p.a.) |

|---|---|---|

| SBI | ~6.5–7.0% | ~7.0–7.5% |

| HDFC Bank | ~6.75–7.10% | ~7.25–7.60% |

| ICICI Bank | ~6.7–7.10% | ~7.2–7.60% |

| Post Office (5 years) | ~6.7% | Same rate for all |

FAQs on RD Calculator

1. What is an RD Calculator?

RD Calculator is a free online tool used to calculate the maturity amount and interest earned on a recurring deposit. Simply enter your monthly deposit, tenure, interest rate, and compounding frequency, and know your payout on maturity.

2. How does an RD Calculator work?

RD Calculator The RD calculator takes into account the recurring deposit scheme offered by all the banks, based on which the investors are expected to deposit a fixed amount of money every month and earn interest at the rate applicable to fixed deposits (FD). It considers the fixed monthly payments, the loan term, the interest rate, and the compounding period to provide you with an approximation.

3. What details do I need to use an RD calculator?

You’ll usually need:

- Monthly deposit amount

- Interest rate (p.a)

- Compounding frequency (monthly, quarterly, etc.)

- Senior citizen status (for extra interest, if applicable)

- Tax slab (to see post-tax returns)

4. Is the interest earned on RD taxable?

Yes. Interest earned on an RD is fully taxable under “Income from Other Sources” in India. Banks also deduct TDS (Tax Deducted at Source) if annual interest exceeds ₹40,000 (₹50,000 for senior citizens).

5. Does the calculator show post-tax returns?

Many advanced RD calculators (like the one shown in your image) allow you to select your tax slab so you can see interest after tax as well as the maturity amount.

6. Can senior citizens get higher RD rates?

Yes. Most banks offer an extra 0.25% to 0.75% interest for senior citizens. Good RD calculators include an option to check this benefit.

7. Is the RD Calculator result exact?

The calculator provides an accurate estimate based on the entered rate and compounding formula. Actual returns may vary slightly based on the bank’s compounding method and policies.

8. Can I use the RD Calculator for Post Office RD?

Yes! Just enter the current Post Office RD interest rate and tenure. The formula works the same way.

9. Is using the RD Calculator free?

Yes. MasterCalculator. In’s online RD calculators are completely free to use and accessible on mobile or desktop.

10. Why should I use an RD Calculator?

It helps you:

✅ Plan your monthly savings

✅ Know the maturity amount in advance

✅ Compare different tenures and rates

✅ Decide on the best RD option for your goals

Sign in to your account